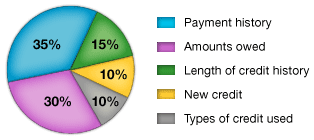

There are five factors that FICO uses to determine your credit score:

- 35% Payment History – (Do you pay on time?)

- 30% Amounts Owed – (Do you use a lot or little credit?)

- 15% Length of Credit History – (How long have you had credit?)

- 10% New Credit – (Have you applied for credit recently?)

- 10% Types of Credit – (Do you have different credit types?)

As you can tell, the two biggest parts of this pie are, “Credit History” and “Account Balance”. Which means two things:

1- If possible, keep your credit card balances below 40%

2- If you have late payments or derogatory accounts, you NEED to get those removed from your credit history as soon as possible. Which is one of the many things our team at Family Credit Repair can assist with.