Having bad credit might be costing you more money than you think. Continue reading to find out how you might be throwing away thousands of dollars every year.

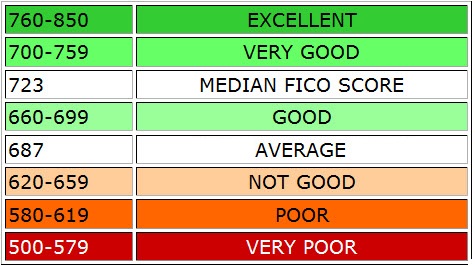

First, take a look to see what category your current FICO score falls into:

Next, lets look at some charts to see how your credit score directly impacts the amount of money that you pay for interest on your auto loans, credit cards, and a mortgage.

Next, lets look at some charts to see how your credit score directly impacts the amount of money that you pay for interest on your auto loans, credit cards, and a mortgage.

How Bad Credit Affects Auto Loans

Lets take a look at the interest cost for an auto loan. For the below numbers, we are using a standard 60 month loan with a fixed rate and financing $20,000:

| Credit | Score | Rate | Payment | Added Cost |

| Excellent | 720-850 | 5% | $377 | $0 |

| 700-719 | 7% | $396 | $1,116 | |

| Moderate | 675-699 | 9% | $415 | $2,265 |

| 620-674 | 12% | $445 | $4,048 | |

| Bad | 560-619 | 18% | $508 | $7,827 |

| 500-559 | 20% | $530 | $9,148 |

How Bad Credit Affects Credit Cards

Now let’s take a look at how your credit score affects the interest rate with your credit cards. For the below numbers, we are using a balance of $5,000 with a fixed rate and a monthly payment of $200:

| Credit | Score | Rate | Balance | Added Cost |

| Excellent | 720-850 | 4% | $5,000 | $0 |

| 700-719 | 6% | $5,000 | $126 | |

| Moderate | 675-699 | 8% | $5,000 | $259 |

| 620-674 | 10% | $5,000 | $401 | |

| Bad | 560-619 | 15% | $5,000 | $803 |

| 500-559 | 21% | $5,000 | $1,404 |

How Bad Credit Affects Home Loans

Now let’s take a look at how your credit score affects the interest rate with a mortgage loan. For the below numbers, we are using a fixed rate 30 year loan with $200,000 being financed:

| Credit | Score | Rate | Payment | Added Cost |

| Excellent | 720-850 | 4.35% | $996 | $0 |

| 700-719 | 4.55% | $1,019 | $8,532 | |

| Moderate | 675-699 | 4.75% | $1,043 | $17,162 |

| 620-674 | 4.95% | $1,068 | $25,890 | |

| Bad | 560-619 | 5.35% | $1,117 | $43,633 |

| 500-559 | 5.95% | $1,193 | $70,941 |

As you can tell, the savings are quite substantial for auto loans, credit cards, and mortgages.